alabama tax lien laws

However the chances are that the property was redeemed. Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home.

Alabama Tax Sales Tax Liens Youtube

Alabama law grants redemption rights to all persons or entities having an ownership interest in the property or who hold a mortgage or lien on the property at the time of the tax sale20 Alabama.

. Alabama Business Privilege and Corporation Shares Tax of 1999. Tax lien certificates not sold at the county level can be purchased from the Alabama State Commissioner of Revenue Sec. A The tax collecting official shall make execute and deliver a tax lien certificate to each purchaser at a tax lien sale or auction or to each assignee thereafter and shall collect from the purchaser or assignee a.

If theyve paid property taxes for the land for at least ten years they are also eligible to submit a claim. Basics of Alabama Lien Law Charles A. Financial Institutions Excise Tax.

Section 35-11-40 - Filing of notice of lien For repeal date - See Code commissioners note. 40-10-21 and 40-10-132. In a tax lien state a priority lien against the property is sold to an investor giving the investor the right to collection the back due taxes and earn interest.

In Alabama once there is a tax lien on your home the taxing authority may hold a tax lien sale. Ray IV Lanier Ford Shaver Payne PC. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land.

Section 35-11-42 - Short title. Demos 599 So2d 1148 2017. This article focuses on tax lien sales The high bidder at the tax lien sale doesnt immediately get title to the property.

If you are considering buying a tax delinquent real estate property contact a Birmingham real estate lawyer. If you bought a tax lien certificate in 2019 in a bid-down auction in Alabama that 2019 tax lien certificate becomes eligible to foreclose on in just a few months. Alabama Tax Lien Sales.

Division 1 Lien for United States Taxes. Search Tax Delinquent Properties. C A tax lien certificate shall bear interest at the rate of 12 percent per annum on the amount of all taxes penalties interest and costs due on the property from the date of the sale of the tax lien to the original purchaser until the tax lien certificate is redeemed as provided by law or the property is sold pursuant to a decree for sale.

The Alabama Senate has a companion Bill SB261 that is waiting on the call of the chair to bring the Bill to a vote. Newman Bros Inc 288 So2d 749 CtAppAla. In the event this lien does not get paid the investor could foreclose it to gain ownership of the property.

In Alabama a tenant can make an adverse possession claim if they have occupied the land or building for 20 continuous years AL Code 6-5-200. Estate and Inheritance Tax. This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No.

Alabama Lien Law Section 8-15-30 Short title. Robert Kennedyfrom Indn Spgs Vlg Alabama. The taxpayer will be unable to sell or transfer his property until the tax lien has been paid.

Instead the buyer receives a tax lien certificate. Where a public entity arranges to pay suppliers including suppliers to the contractor and subs directly in order to avoid paying sales tax if the public entity fails to pay the suppliers may bring a claim on the payment bond. Alabama Tax Lien Certificates Mature 2 April 2022.

ALABAMA Code 35-11-213 mandates that a notarized ALABAMA Statement Of Lien can be recorded at any time up to four 4 months Subcontractors or six 6 months GeneralPrime Contractors after the last day providing equipment labor materials or services for a private Commercial project. In Alabama the purchaser of a tax certificate is entitled to immediate. The lien is usually recorded in the Office of the Judge of Probate of the county where the taxpayer resides or owns property.

As of this writing 200 of 236 Shelby County Liens have been redeemed. 2101 West Clinton Ave Suite 102 Huntsville AL 35805 256-535-1100. Division 2 Alabama Uniform Federal Lien Registration Act.

Section 35-11-41 - Record of notices For repeal date - See Code commissioners note. Alabama tax lien laws Sunday March 6 2022 Edit. A tax lien refers to a property owners outstanding tax debt.

Alabama statutes are very specific about the language and formatting required in a lien claim document. Although the Department of Revenue does not give notice of a lien to credit reporting agencies the lien is a public record. One option is to buy tax delinquent properties from the state of Alabama.

Some homeowners might face a tax foreclosure instead of a tax lien sale. Download a blank mechanics lien form to use when filing a claim in Alabama. While it might be a financially wise choice it is more complex from a legal perspective than you might imagine.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas Alabama Application For Vintage Vehicle License Plates Mvr 40 12 290 Car Title Vintage Cars Boat Trailers 2 2. Once there is a tax lien on your home the taxing authority may hold a tax lien sale. Provided the property owner is unable to pay the debt for an extended period which will be defined by the local tax authority the next step is to issue a tax certificate.

Article 3 Federal Lien Registration. Our free forms were created by construction attorneys to meet the requirements in Alabamas mechanics lien laws. Alabama is a tax lien state.

Financial Institutions Excise Tax. As the purchaser of an Alabama tax lien certificate you need to be aware that you will need to consult a legal professional for assistance with a quiet title action. Neither an assignment nor a tax deed gives the holder clear title to the parcel.

The reason I capitalized MAY COUNTY will be. Estate and Inheritance Tax. 1321 1 Section 8-15-31 Definitions.

In Alabama a creditors ability to collect under a judgment lien will be affected by a number of factors -- including a fixed amount of value that wont be touchable if the property is the debtors primary residence called a homestead exemption other liens that may be in place and any foreclosure or bankruptcy proceedings. For purposes of this article the following words and phrases shall have the respective meanings ascribed by this section. On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your COUNTY.

It is advisable to consult a competent attorney regarding your contemplated purchase of tax delinquent property. In Alabama taxes are due on October 1 and become delinquent on January 1.

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

5 17 2 Federal Tax Liens Internal Revenue Service

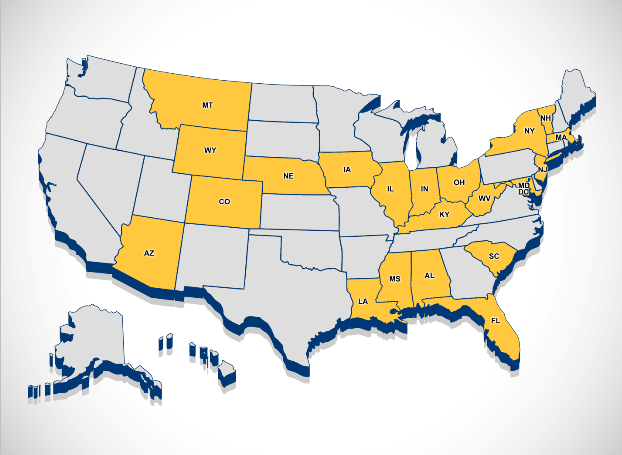

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Arkansas Billofsale Bill Of Sale Template Word Template Professional Templates

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Blue Nile Sales Tax The Ring Adviser

Pin On Sales Tax For Photographers

Tax Notice Error Causes Homeowners To Fear Eviction Wbma

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Alabama Application For Vintage Vehicle License Plates Mvr 40 12 290 Car Title Vintage Cars Boat Trailers